US bond yields rise as surge in job creation leaves mid-year rate rise on the table

The US labour market showed no signs of cooling at the start of the year, despite recent evidence that suggested the economy moved down a gear during the winter months. Employment once again grew more than expected in January and wage growth picked up.

The job market data leave the door open for a first hike in interest rates in the summer, causing a further upturn in Treasury yields as the prospect of rate hikes becomes an increasing reality. However, the FOMC are not due to consider policy until their next meeting on 17-18 March.

Cooling economy

The upbeat jobs data follow news that the rate of economic growth almost halved in the fourth quarter of last year, a slowdown which was predicted by business surveys and which also points to the modest pace of expansion continuing into the New Year. Markit's January PMI surveys showed the weakest rise in US companies' order books since the recession. Recent retail sales and factory orders data have also disappointed.

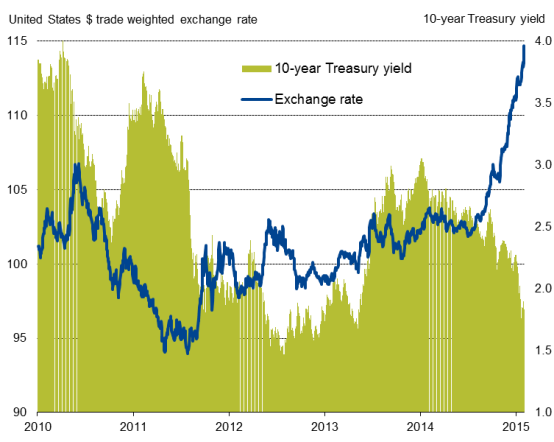

The US dataflow has become more bearish in part due to the dollar's recent strength. With FX markets pricing in a US rate hike before other major central banks, and contrasting with policy easing in the eurozone and Japan, the Greenback is at its highest since 2003 on a trade-weighted basis.

Corporate earnings reports are consequently awash with warnings of how the strong dollar is hurting exports and hitting profits. Companies might therefore start taking a more cautious approach to hiring in coming months.

If continued in coming weeks, the weaker data flow points to rates not being hiked until the second half of 2015, and perhaps policy even being on hold until 2016 if events such as the Greek debt talks and geopolitical worries over Russia add to economic uncertainty and dampen global demand. However, unless such a sharp slowing in the economy and job market materialises, a mid-year rate rise remains very much on the table.

Bond market wakes up to policy outlook

Unlike the FX markets, until recently the bond market has shown no signs of pricing in higher interest rates, with 10-year treasury yields hovering around record lows in recent sessions. However, yields have risen from a low of 1.69% at the end of January to a two-week high of 1.896%, according to Markti iBoxx data, as the reality of higher US interest rates comes closer.

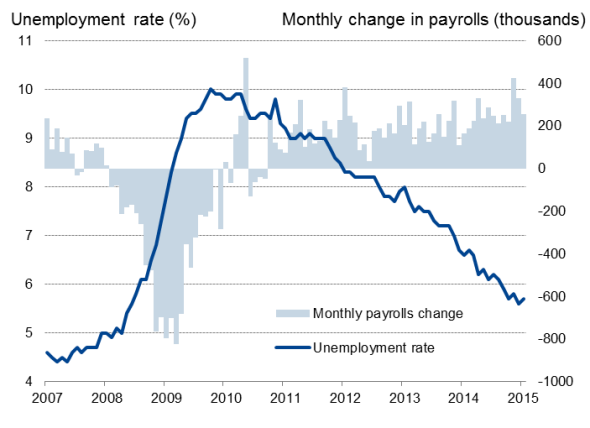

Employment and unemployment

Hiring surge continues in New Year

In the detail of the employment report, non-farm payrolls surged by 257,000 in January, once again smashing expectations. Markets were pricing in a 234,000 rise. Private sector payrolls rose 267,000 while government jobs fell by 10,000.

The good news didn't stop there. Data for November and December were revised up markedly to show an extra 147,000 more new jobs than previously estimated. November alone saw 423,000 new jobs, the largest rise since May 2010.

The latest increase also means this is the first time that 200,000 or more jobs have been added over a consecutive 11-month period since 1994.

Despite the payroll growth, the unemployment rate edged higher from December's six-and-a-half year low of 5.6% to 5.7%, but this was linked to an increase in labour force participation. The rise in the participation rate from 62.7% to 62.9% suggests that more people are re-entering the job market as optimism about the economy improves.

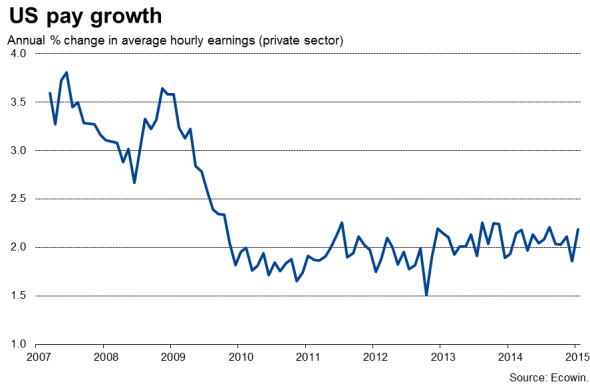

Wage growth remains a major disappointment, but is at least showing signs of picking up. Annual pay growth rose from 1.9% in December to 2.2% in January. While that's the highest since last August, the rate at which pay is rising clearly remains worryingly subdued given the economy's impressive rate of growth over the past year and could also act as a dampener on policymakers' enthusiasm for raising interest rates.

Exchange rate and bond yields

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com